Content

- Do Small Businesses Need Accountants?

- Ways Accountants Help Business Owners Make Smarter Business Decisions

- Certified Public Accountant (CPA)

- What Are the Basics of Small Business Accounting?

- It Helps to Create Budget and Future Projections

- The Importance of an Accountant for Your Small Business’s Success

Your how an accountant can help your business will play an important role in keeping you grounded, and helping to ensure success. Not all bookkeepers are accountants, but all accountants can be bookkeepers. Bookkeepers handle a bunch of stuff for your business, from bill payments to weekly reports. While they’re experts at handling plenty of financial responsibilities, they’re not required to have the licenses that allow them to represent you to the IRS or to prepare your taxes. Reducing tax liabilities is crucial for any growing business and means that you are keeping your finances on track and following the correct procedures to pay your taxes. Hiring an accountant to handle your finances ensures that you do not have to directly deal with any financial matters, and the accountant can help you save time and money.

Whether you’re a seasoned investor or just starting out, https://www.home-investors.net/new-york/investors-that-buy-houses-oneonta-ny/ offers valuable insights for everyone.

Your sales and marketing process will require you to spend money, whether it’s on tactics or hiring the right kind of help. It’s crucial to ensure these activities are producing a sustained ROI for your business and leading to higher profits overall. Your accountant will also give you a sense of necessary startup costs and investments, and can show you how to keep functioning even in periods of reduced or negative cash flow. Aside from just heading off problems, a CPA can help you maximize tax benefits and claim all the deductions and credits your business is entitled to.

Do Small Businesses Need Accountants?

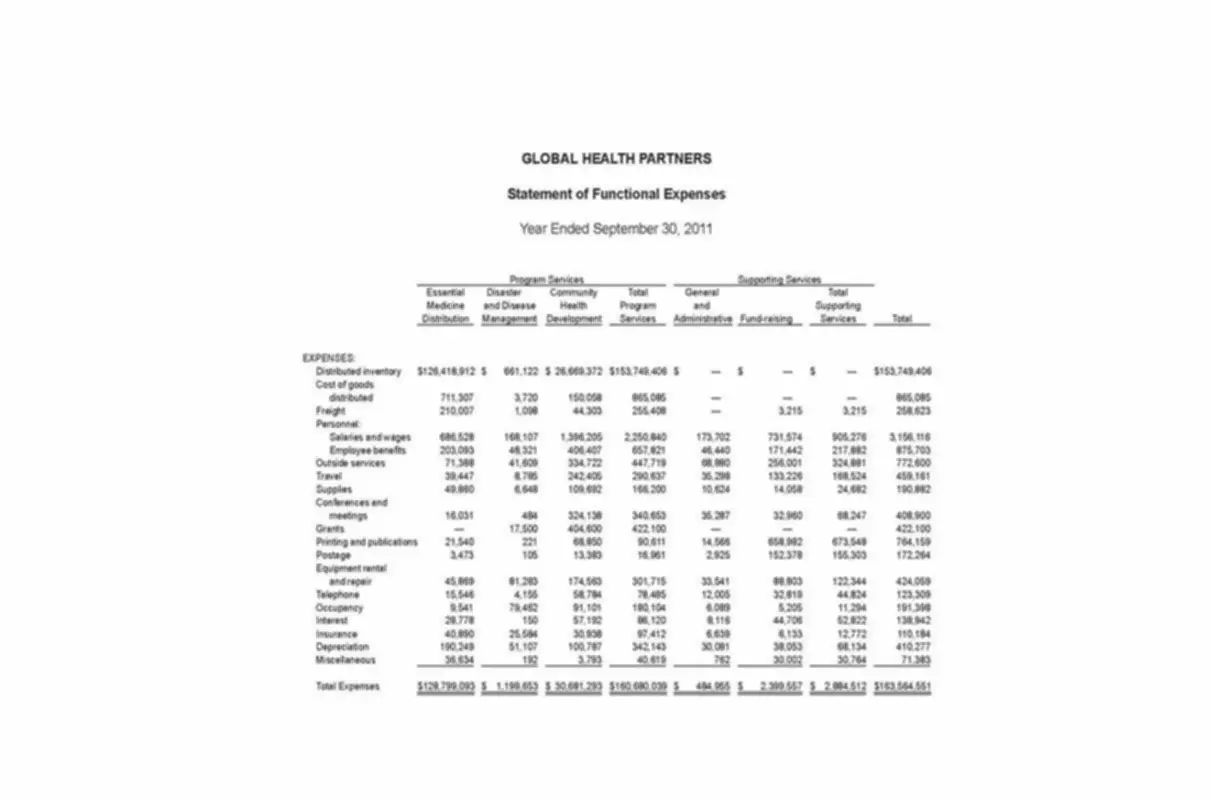

From payroll expenditure to tax compliance, an accountant makes things easier in terms of business accounting issues including business formation, business proposals, loan application, and tax or auditing. Whether you make small gains over time, or you experience exponential growth, you’ll need an accountant to help you plan for the long-term. Lack of foresight can be the downfall of even the most buzz-worthy businesses.

Because the relationship will be a close one, make sure you choose an accountant with whom you get along well. You will be working closely together so you want to hire someone you can trust and are comfortable with. A good accountant is a partner; they support you and your business all year long, not just at tax time. Things change fast when you own a small business, so partnering with a proactive accountant is the only way to make sure that you are taking advantage of all possible tax savings. Your accountant can provide you with reports throughout the year so you can monitor your financial progress and make adjustments where necessary. The tax code also changes often so even if you understand something now, in a year, the code may be different. Your accountant knows the tax code and stays up-to-date on changes to it and will ensure that you are getting the maximum benefits.

Ways Accountants Help Business Owners Make Smarter Business Decisions

From transactions at a https://www.bookstime.com/ register to the operations of financial markets and farms, accountants play a prime role in the functioning of all types of businesses and organisations. DIY small business accounting will become complex as your company grows. Keeping track of all the creditors and debts owed, or measuring key metrics to startup accounting can turn cumbersome.

Additionally, it is a good idea to start calling around and getting referrals from friends and family. An accounting clerk must have at least a high school diploma and on-the-job training. A CPA must have an accounting degree and additional certifications. A recognized and reliable source where you can look for an accountant is the American Institute of Certified Public Accountants , which has a license verification directory of CPAs. Chartered accountants tend to do commercial work within corporations, rather than doing public practice work for other entities.